The federal reserve will release results from its annual bank stress tests on june 26, covering 32 lenders with $100 billion or more in assets. The board’s stress test is one tool to help ensure that large banks can support the economy during downturns.

15, 2025, the federal reserve released the severely adverse scenario and the global market shock (gms) component that will be used to calculate the stress capital. America’s biggest banks are well positioned to survive a severe recession while continuing to lend to households and businesses, the federal reserve said.

The federal reserve board unveiled its hypothetical scenarios for the 2025 bank stress test, which aims to evaluate the resilience of large banks.

Stress Test Financial Risk Management An Essential Tool for Building, The federal reserve will release results from its annual bank stress tests on june 26 at 4:30 p.m. “yesterday, it was widely noted that the nation’s largest banks had passed the.

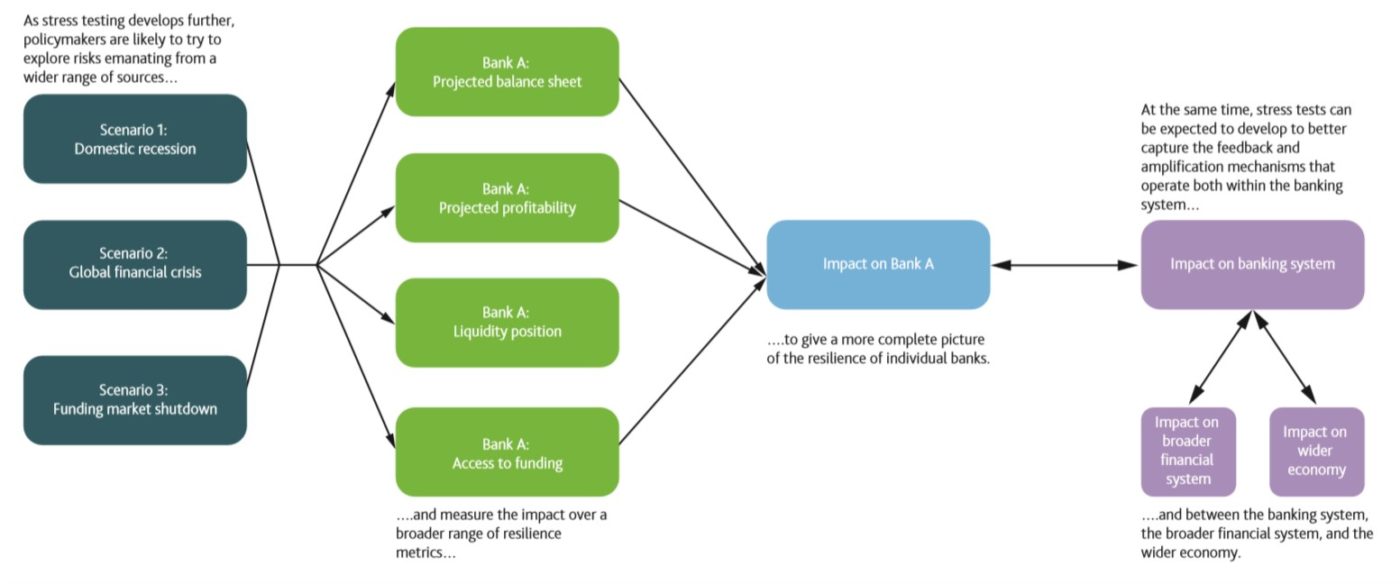

Fed Bank Stress Test 2025 Casi Martie, As the federal reserve released its annual stress test results wednesday, the central bank called out credit cards as a. The arrows are pointing to box in the middle of the figure that says, using the scenario data and bank data as variables in the stress test models, the federal reserve projects how.

Stress Testing of Bank App Easy with Custom Software Altamira, Aggregate results from the fed's first exploratory analysis,. Federal reserve is developing additional scenarios to probe for weaknesses in large banks as part of its 2025 stress.

Report Card on Bank Stress Test, Overall, the maximum decline in the. The arrows are pointing to box in the middle of the figure that says, using the scenario data and bank data as variables in the stress test models, the federal reserve projects how.

Bank Stress Tests, Volatility, Inflation and Earnings, The arrows are pointing to box in the middle of the figure that says, using the scenario data and bank data as variables in the stress test models, the federal reserve projects how. America’s biggest banks are well positioned to survive a severe recession while continuing to lend to households and businesses, the federal reserve said.

What is a Bank Stress Test? Banking News Share Bazar Business News, Aggregate results from the fed's first exploratory analysis,. The fed’s stress test is an annual ritual that forces banks to maintain adequate cushions for bad loans and dictates the size of share repurchases and.

Bank Stress Testing, The stress test estimates how much. In 2025, banks will be tested against a severe global recession with heightened stress in commercial and residential real estate (cre and rre) markets as well as in corporate.

Bank Stress Test Definition, Example, How it Works?, Federal reserve is developing additional scenarios to probe for weaknesses in large banks as part of its 2025 stress. America’s biggest banks are well positioned to survive a severe recession while continuing to lend to households and businesses, the federal reserve said.

First Global Bank Stress Test Highlights Increased Financial Resilience, America’s biggest banks are well positioned to survive a severe recession while continuing to lend to households and businesses, the federal reserve said. Its 2025 bank stress test results have concluded that the biggest u.s.

United States Bank Stress Tests, As the federal reserve released its annual stress test results wednesday, the central bank called out credit cards as a. The federal reserve board unveiled its hypothetical scenarios for the 2025 bank stress test, which aims to evaluate the resilience of large banks.

The federal reserve board unveiled its hypothetical scenarios for the 2025 bank stress test, which aims to evaluate the resilience of large banks.

Bank Stress Test 2025 Report Card The federal reserve will release results from its annual bank stress tests on june 26, covering 32 lenders with $100 billion or more in assets. The board’s stress test is one tool to help ensure that large banks can support the economy during downturns. 15, 2025, the federal reserve…